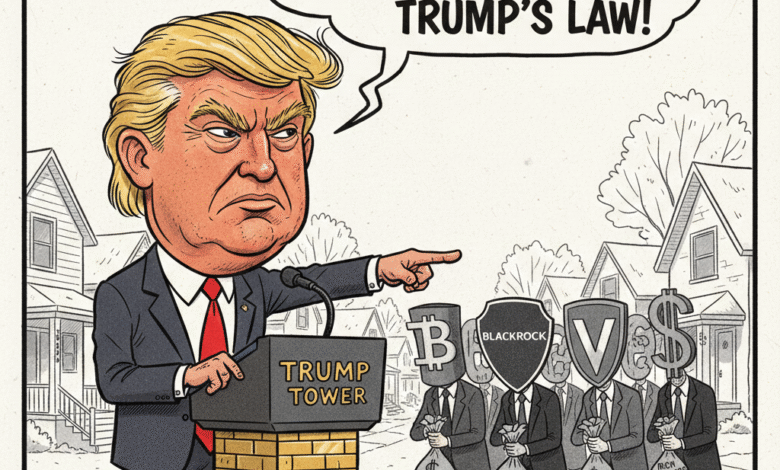

In early January 2026, President Donald Trump reignited a long-running housing debate with a blunt promise: push Wall Street out of America’s neighborhoods. Framed as a fight to restore the “American Dream,” the proposal targets large institutional investors accused of crowding out first-time buyers. But behind the headline is a far more complex policy moment—one that could reshape markets unevenly, help some buyers, unsettle others, and leave places like Northern New Jersey and Brooklyn in very different positions.

Is the Ban Real — And Has It Happened Yet?

Yes, the commitment is real. The policy, however, is not yet law.

On January 7, 2026, President Trump posted on Truth Social that his administration is “immediately taking steps” to ban large institutional investors from purchasing residential homes. That statement triggered sharp market reactions—but as of mid-January 2026, no formal Executive Order has been fully signed or implemented.

Current Status (as of mid-January 2026)

- A draft Executive Order is reportedly circulating within the administration

- Full details are expected to be unveiled either:

- at the World Economic Forum in Davos (late January), or

- during the State of the Union on February 24, 2026

- Congress has been urged to codify the policy into law to withstand legal challenges

The Two-Track Strategy

The administration has signaled a dual approach:

- Executive Action to immediately restrict future institutional purchases

- Legislative Pressure on Congress to formalize the ban long-term

This matters because executive authority alone may not survive court scrutiny—especially if property rights or interstate commerce claims are raised.

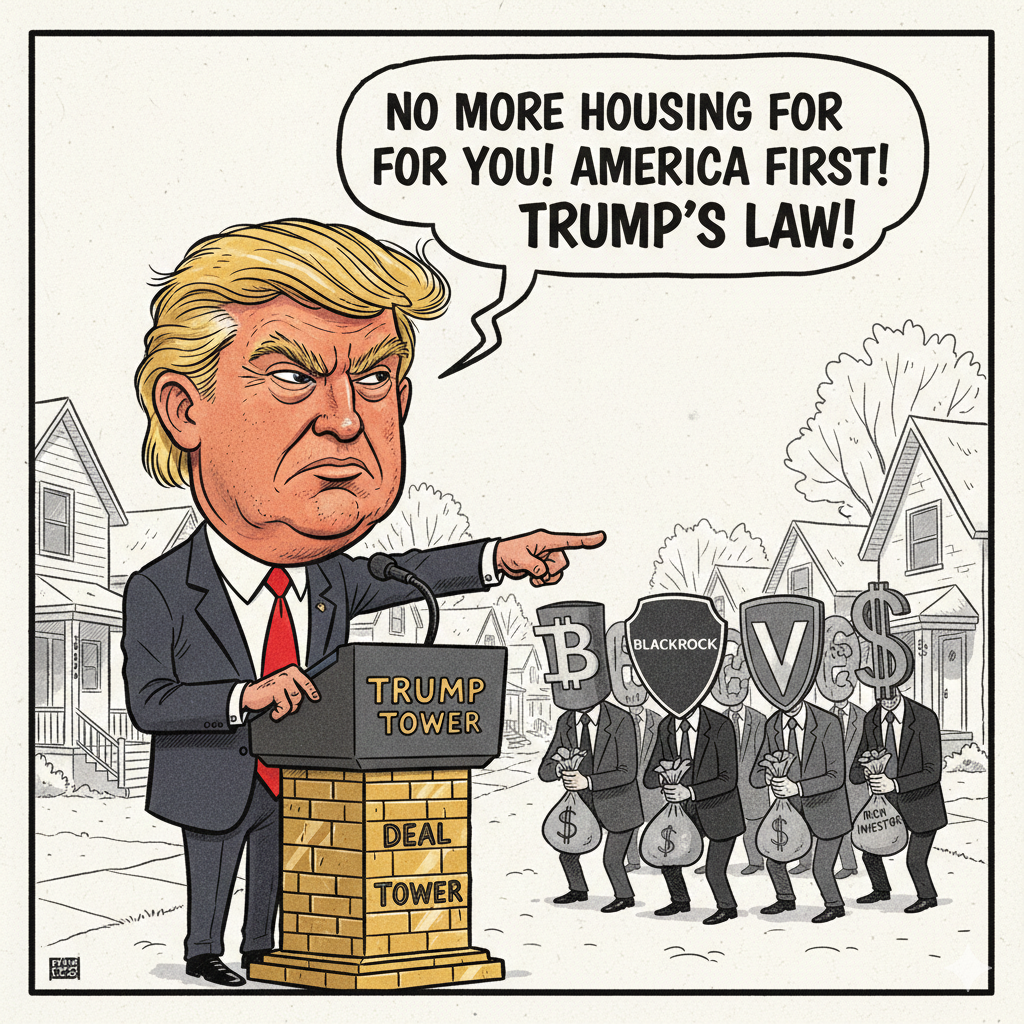

What Would the Ban Actually Cover?

While final language is still pending, multiple drafts and policy leaks point to a relatively narrow—but impactful—target.

Likely Scope of the Ban

- Who:

- Large institutional investors, often defined as entities owning 50–100+ residential properties

- What:

- Primarily single-family homes

- Who’s in the crosshairs:

- Major Single-Family Rental (SFR) operators

- Private equity firms such as Blackstone and similar asset managers

- Who may be exempt:

- Small landlords (“mom-and-pop” owners)

- Potentially Build-to-Rent (BTR) developers (still under debate)

A Rare Bipartisan Overlap

Notably, this proposal overlaps with years of criticism from Democrats such as Senator Elizabeth Warren, who has long warned about “Wall Street landlords.” That doesn’t guarantee legislative success—but it does complicate the usual partisan lines.

The Hard Part: Making the Ban Actually Work

Announcing a ban is easy. Enforcing it is not.

1. Unmasking LLC Ownership

Institutional investors rarely buy property directly. They use thousands of LLCs, often one per home.

To enforce a ban, the federal government would likely need:

- a centralized beneficial ownership registry, or

- expanded access to FinCEN ownership data tied directly to property records

Without this, enforcement becomes symbolic rather than real.

2. Defining “Institutional” Without Collateral Damage

The threshold matters:

- Too high → mid-sized hedge funds slip through

- Too low → small landlords get swept in

Most current drafts use 50–100 properties as the cutoff, but this remains unsettled.

3. Enforcement Tools on the Table

Possible mechanisms include:

- Restricting access to federally backed mortgages

- FHFA and HUD compliance oversight

- Heavy tax penalties for prohibited purchases

4. The Build-to-Rent Dilemma

If companies that build new homes specifically for rent are included:

- total housing supply could shrink

- prices could rise, not fall

If they’re excluded:

- corporations may simply pivot harder into BTR developments

5. Avoiding a Localized Price Crash

Forcing large investors to sell too quickly—especially in markets like Atlanta or Phoenix—could:

- crash local prices

- erase middle-class homeowner equity

- destabilize municipal tax bases

Managing a “price floor” becomes critical.

Wall Street Reacts: A Tale of Two Markets

The financial sector didn’t wait for final policy language.

1. Corporate Landlords: Immediate Sell-Off

Following the January 7 announcement:

- Invitation Homes (INVH): down ~6–7% in one day

- American Homes 4 Rent (AMH): down ~6%

- Blackstone (BX), Apollo (APO): down ~4–5%

- Multiple analysts downgraded the sector, citing existential growth risk

The market is pricing in a fundamental break in the SFR business model.

2. Mortgage Rates: A Surprise Twist

One day later, the administration announced a separate move:

- $200 billion directive for Fannie Mae and Freddie Mac to purchase mortgage-backed securities (MBS)

Result:

- 30-year fixed mortgage rates drifted toward ~6%, the lowest in nearly three years (Source Needed)

Economists debate whether $200B is large enough to structurally shift an $11T market—but sentiment changed immediately.

3. Industry Winners Emerge

| Sector | Key Players | Market Reaction | Why |

| Corporate Landlords | Invitation Homes, Blackstone | Down 5–10% | Growth model threatened |

| Homebuilders | LGI Homes, Hovnanian | Up 20%+ | Expect more first-time buyers |

| Mortgage Lenders | Rocket, LoanDepot | Up 2–7% | Higher origination volume |

| Mortgage Rates | 30-Year Fixed | Dropped toward ~6% | Federal bond intervention |

What This Means for Northern New Jersey

Northern NJ is one of the few Northeast markets where institutional buying has been rising—especially in urban cores.

Newark: A Direct Hit

A 2025–2026 Rutgers study found corporate buyers accounted for ~47% of residential sales in Newark’s 1–4 unit market (Source Needed).

If accurate, a ban would:

- meaningfully slow corporate consolidation

- free inventory for local families

- reshape investor behavior in Newark and Paterson

Suburbs: Minimal Relief

In towns like Montclair, Ridgewood, or Morris County, institutional investors are not the main competitors. Buyers there are mostly:

- wealthy individuals

- small landlords

Prices may not fall—but rate relief matters more.

The Rate Effect Matters More Than the Ban

With some of the highest property taxes in the country, NJ buyers are extremely monthly-payment sensitive. The drop toward 6% has already sparked renewed activity near transit hubs.

What This Means for Brooklyn

Brooklyn is largely insulated from the core ban.

Why the Impact Is Limited

- The SFR model barely exists

- Most housing is:

- condos

- co-ops

- 2–4 family brownstones

- Median prices surpassed $1M in late 2025 (Source Needed)

Institutional landlords don’t buy $2M brownstones to rent.

The Real Risk: Capital Migration

Some analysts worry that blocked SFR capital may:

- pivot aggressively into multifamily rentals

- push rents higher in new developments in Williamsburg or Downtown Brooklyn

Northern NJ vs Brooklyn (2026 Outlook)

| Feature | Northern NJ | Brooklyn |

| Institutional Presence | High in urban centers | Very low |

| Sensitivity to Policy | High | Moderate |

| Price Forecast | 1–3% growth | 4–6% growth |

| Main Threat | Tariffs & build costs | Inventory scarcity |

“Mom-and-Pop” Landlords (5–10 Properties): Quiet Winners

For small Tri-State landlords, this moment is mostly favorable.

1. Likely Exempt From the Ban

Most drafts define institutional investors as owning 50–100+ homes.

- You’re likely exempt

- Your biggest competitors may disappear from bidding wars

2. Major Tax Wins in 2026

Recent legislation preserved and expanded key benefits:

- 20% QBI deduction (Section 199A) made permanent

- SALT cap raised to $40,000 through 2029

- 1031 exchanges preserved

For NJ and Brooklyn owners, this is significant.

3. The Hidden Costs

Not everything is positive:

- Tariffs on lumber, steel, aluminum have raised renovation costs

- Contractor labor shortages are pushing trade costs up 20–30% in some cases (Source Needed)

Summary for 5–10 Property Owners

| Policy | Impact |

| Institutional Ban | Positive — less corporate competition |

| Tax Policy | Very positive |

| Mortgage Rates | Positive for refis & acquisitions |

| Trade/Labor Costs | Negative — higher operating expenses |

What This Moment Actually Reveals

This isn’t just about banning investors. It’s about whether housing policy can be recalibrated without creating new distortions.

For Northern New Jersey buyers, mortgage rates matter more than the ban itself.

For Brooklyn buyers, supply—not Wall Street—is still the core issue.

For small landlords, this may be the most favorable policy mix in years—if costs don’t spiral further.

The real test comes when draft language becomes enforceable law.

Key Takeaways

- The investor ban is real but not yet implemented

- Enforcement hinges on defining ownership and unmasking LLCs

- Mortgage rate intervention may matter more than the ban itself

- Northern NJ sees meaningful impact; Brooklyn largely does not

- Small landlords are mostly protected—and in some cases advantaged

HfYC Poll of the Day

Follow us and respond on social media, drop some comments on the article, or write your own perspective!

Do you believe banning institutional investors will actually make housing more affordable?

Poll Question Perspectives

- Is Wall Street really the problem—or is housing supply the bigger issue?

- Should small landlords be protected while large investors are restricted?

- Would you support this ban if it raised rents but lowered home prices?

Related HfYC Content

- Is the U.S. Housing Crisis a Bubble About to Burst—or a Slow Reset?

- Brooklyn’s Cost of Living Crisis – Who Gets to Stay, Who’s Being Pushed Out?

- First-Time Black Homebuyer’s Guide to NJ & NY | Assistance & Grants

References

- Truth Social statement by President Donald Trump, January 7, 2026

- FHFA directive regarding mortgage-backed securities purchases, January 2026

- Rutgers University housing market analysis (2025–2026) — Source Needed

- Mortgage rate movement analysis, January 2026 — Source Needed