What The Real Estate Moguls of NJ/NY Are Doing Right Under Your Nose

Quiet Giants: How Under-the-Radar Builders Are Reshaping Our Blocks

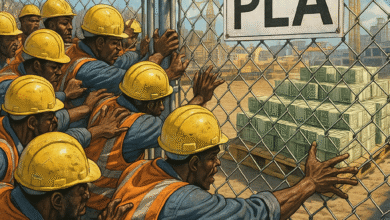

Let’s name the focus up front: Black real estate investors in NJ/NY are moving differently—and moving the market. From Newark’s brick walk-ups to Brooklyn’s brownstones and Jamaica, Queens multifamily rehabs, a wave of owners, syndicators, and small-to-mid-size developers are building wealth and stabilizing neighborhoods without the headlines. This feature kicks off a recurring HfYC series profiling what the real estate investors in NJ/NY who turn boarded-up lots into livable homes, raise capital, and retain ownership in the zip codes we love.

Why it matters? Because rent is high, starter homes feel mythical, and TikTok hasn’t told the full story. Local moguls offer receipts (if you ask nicely)—roadmaps for how we “regular people” leverage FHA loans, construction lines of credit, tax abatements, community land trusts, and sheer grit to create equity that lasts.

The Playbook: What Separates Builders From Buyers

Before we meet the folks, clock the pattern. The quiet moguls tend to:

- Start small, scale smart. Duplex → four-unit → 10+ doors; or one flip → small portfolio.

- Live the numbers. Cap rates, DSCR, debt service, cash-on-cash return—no guesswork.

- Use place-based tools. Historic tax credits, first-time homebuyer programs, Section 8 vouchers, rent stabilization compliance.

- Build teams. Realtor + lender + GC + property manager + attorney + CPA.

- Give back. Apprenticeships, tenant-first renovations, neighborhood hiring, local lender relationships.

For Gen Z and young millennials, this isn’t just a wealth path; it’s an organizing strategy. Ownership stabilizes families, keeps elders in place, and creates community leverage at zoning meetings and ballot boxes.

Profiles in Quiet Power (Vol. 1)

These first-look snapshots set the tone for our deeper-dive series. Each person has agreed to share lessons learned; details are condensed to protect privacy where requested. Future installments will expand with full interviews, project budgets, pro formas, and “how they did it” step-by-steps.

1) The Duplex Scientist — Essex County, NJ

Focus: House-hack to portfolio

Signature move: FHA 3.5% down on a two-family, living in Unit A while renovating Unit B with a 203(k) rehab loan. After stabilization, a cash-out refi funded a nearby triplex.

Community impact: Rents one unit to a single mother using a voucher, keeps the unit upgraded and affordable.

Youth lesson: Live in your first deal. Your rent becomes your runway.

2) The Brownstone Heir—Bed-Stuy, Brooklyn

Focus: Intergenerational wealth, historic preservation

Signature move: Inherited a half-interest in grandma’s brownstone; executed a family buyout via HELOC and a construction loan, created an owner’s duplex plus two rentals. Took advantage of historic facade credits and local façade program guidance.

Community impact: Kept the home in the family, created two attainable-rent apartments for long-term neighbors.

Youth lesson: Probate planning is a development strategy. Put the paperwork first—wills, trusts, beneficiary deeds.

3) The Transit-Line Syndicator—Queens, NY

Focus: Small-dollar equity crowdfunding + 12-unit walk-up

Signature move: Assembled $600k from 48 local investors (avg. check under $15k) to buy and re-position a rent-stabilized building near the E/J lines. Paired energy-efficiency upgrades with property-tax incentives, improving NOI without displacing tenants.

Community impact: Quarterly updates to community investors, local suppliers only, tenant legal clinics onsite.

Youth lesson: You don’t need one whale; you need a pod. Compliance matters—use counsel for any public raise.

4) The Corner-Store Reclaimer—Newark, NJ

Focus: Mixed-use (retail + workforce apartments)

Signature move: Acquired a vacant corner retail with two floors above it through the city’s RFP. Matched a CDFI construction loan with main-street grants, then curated a local coffee tenant downstairs and 3 workforce-rate units upstairs.

Community impact: First Black-owned storefront on that block in 20 years; Saturday youth barista program.

Youth lesson: Mixed-use is math + mission. Underwrite the retail tenant like they’re your partner—because they are.

5) The Jersey City ADU Evangelist—Hudson County, NJ

Focus: “Missing middle” gentle density

Signature move: Converted garages and rear-yard structures into accessory dwelling units (ADUs) where allowed, increasing family income without changing neighborhood character.

Community impact: Keeps seniors in place by turning their property into a two-income household; matches units with nurses and teachers.

Youth lesson: Zoning literacy is a superpower. Read your local code like a comic book—panel by panel.

Short-Term Wins, Long-Term Stakes

Right now (short-term):

- Vacant-to-vibrant conversions bring immediate safety and foot traffic.

- Cash-flowing rentals help owners fight inflation and fund home repairs for elders.

- Apprenticeships create first construction jobs for teens and 20-somethings.

Over time (long-term):

- Intergenerational equity means college paid, businesses seeded, and fewer emergency moves.

- Stable Black ownership keeps cultural anchors—churches, salons, bookstores—in the neighborhood fabric.

- More Black developers at the table = better community benefits agreements (CBAs), stronger pushback against predatory specs, and smarter anti-displacement strategies.

What Young Readers Ask Most (and What These Moguls Said Back)

“I don’t have rich parents—how do I start?”

- House-hack. Or squad up for a small JV (joint venture). Start where the math works, not where the ‘Gram is pretty.

“Flips or holds?”

- Flips build cash. Holds build freedom. Most do both—flip to fund down payments, hold for long-term wealth.

“How do I compete with cash buyers?”

- Speed + certainty. Get underwritten with lenders in advance, approach off-market owners with a clear plan, and make your inspection timeline tight but fair.

“How do I avoid being ‘the gentrifier’?”

- Hire hyper-local; protect at least one unit at attainable rent; start a tenant advisory; invest in block-level safety without criminalization.

The Friction: Risks and Real Talk

- Rates & refinancing risk. Rising interest rates can stall projects; good operators bake in conservative exit assumptions.

- Permitting delays. Municipal timelines can stretch; relationships—with inspectors, council members, and neighborhood groups—matter.

- Contractor shortages. Lock in scopes and retainers early; pay on time; grow your own talent pipeline.

- Predatory lending. If it sounds too easy, it probably is. Vet every term sheet with an attorney/CPA.

Roadmap: How to Move From Renter to Builder

- Pick a lane: House-hack? ADU? Triplex? Mixed-use? Don’t chase everything.

- Assemble your five: Realtor, lender, GC, attorney, CPA. Add a mentor.

- Study your block: Zoning, comps, rents, school catchments, transit.

- Run the numbers: DSCR ≥ 1.25, contingency 10–15%, realistic vacancy, maintenance reserve.

- Start with service: Build equity and community—hire local, protect tenants, beautify the block.

Key Takeaways

- Black real estate investors in NJ/NY are proving that ownership is both wealth strategy and community care.

- Start small, learn fast, and let the numbers lead.

- Protect tenants, hire local, and use every tool—credits, grants, CDFIs—to keep equity rooted in our neighborhoods.

- Your first deal isn’t your last identity. It’s the first chapter.

Call to Action: Nominate the Next Profile

Know a low-key legend turning keys into community in Newark, Jersey City, Paterson, Brooklyn, Queens, the Bronx, or Staten Island? Send tips (with contact info, photos, or addresses) so we can feature them next. This is your series—let’s document our builders while they’re still building.

Related HfYC Content

- First-Time Black Homebuyer’s Guide to NJ & NY | Assistance & Grants

- Is the Housing Market for Black NJ Residents is Going Up in Smoke?

- The Silver Tsunami: How Boomers Are Winning the New Jersey Housing War

- A Playbook for Buying a House and Building a Fairer Future

- The Stories Our Neighborhoods Deserve

- Tariffs, Trade, and the Black Bottom Line

- How to Get Involved with Your Local Government

Other Related Content

References (APA Style)

- HUD. (n.d.). Section 203(k) Rehabilitation Mortgage Insurance Program.https://www.hud.gov/program_offices/housing/sfh/203k/203k–df

- Lincoln Institute of Land Policy. (2022). Community land trusts and housing affordability. https://www.lincolninst.edu/

- Local Initiatives Support Corporation (LISC). (2023). Financing tools for small developers: CDFIs and main street grants. https://www.lisc.org/

- New Jersey Economic Development Authority. (2024). Small business & main street grant programs.https://www.njeda.com/

- NYC Department of Housing Preservation & Development. (2024). Affordable housing programs & tax incentives.https://www.nyc.gov/site/hpd/index.page