Jersey City Creative Economy: Black Businesses in a Pilot Phase

In Jersey City, culture has never just been expression — it has been infrastructure. As the Jersey City Creative Economy moves deeper into 2026, Black-owned creative businesses are navigating a moment that feels both promising and precarious. Public arts funding is opening new doors, but rising commercial rents are quietly narrowing others. The question is not whether culture matters here — it’s who gets to sustain it.

A Grant Cycle That Signals Investment

On January 26, 2026, the Jersey City Arts and Culture Trust Fund opened its 2026–2027 grant cycle, with awards expected to be announced in April. For many small creative entrepreneurs — designers, studio owners, cultural producers — these grants represent more than programming dollars. They can mean short-term stability, payroll coverage, or the ability to activate underused space.

Grants help creatives test ideas. They help fund exhibitions, performances, and pop-ups that bring foot traffic into neighborhoods. But grants are, by definition, cyclical. They operate on application windows and award timelines — not long-term rent agreements.

For Black entrepreneurs, this distinction matters. A one-year grant can launch a vision. It cannot always secure a five-year lease.

Commercial Reality: The Cost of Staying Visible

Northern New Jersey’s commercial real estate market continues to evolve. Public listings show Class A office asking rents in the region averaging above $32.02 per square foot, with year-over-year increases around 1.6%. While not every creative business leases Class A space, these benchmarks influence surrounding pricing.

For a boutique on Monticello Avenue or a studio near the Powerhouse Arts District, the pressure shows up in triple-net leases, property tax pass-throughs, and annual escalations. Even modest increases compound quickly for early-stage operators.

This is where the phrase “pilot phase” becomes more than a startup metaphor. Many creative businesses are intentionally operating lean:

- Short-term leases instead of long-term commitments

- Shared studio models

- Event-based retail instead of full weekly hours

- Digital-first sales with physical activations

These are not signs of instability. They are survival strategies.

Economic Sovereignty and the Racial Wealth Gap

The stakes are larger than storefront aesthetics. According to reporting on statewide contracting disparities, Black-owned firms in New Jersey have historically received less than 1% of certain state contract dollars.

That statistic is not just about construction or procurement — it reflects structural access to capital. Entrepreneurship within the Jersey City Creative Economy becomes one pathway toward economic sovereignty: ownership instead of dependency, equity instead of extraction.

We’ve explored this broader tension before in $600K New Jersey Racial Wealth Gap = Gentrification Today + Homelessness Tomorrow, where housing access and wealth disparities intersect. Creative businesses sit directly in that crosscurrent. They shape neighborhood identity while navigating the very market forces that can displace them.

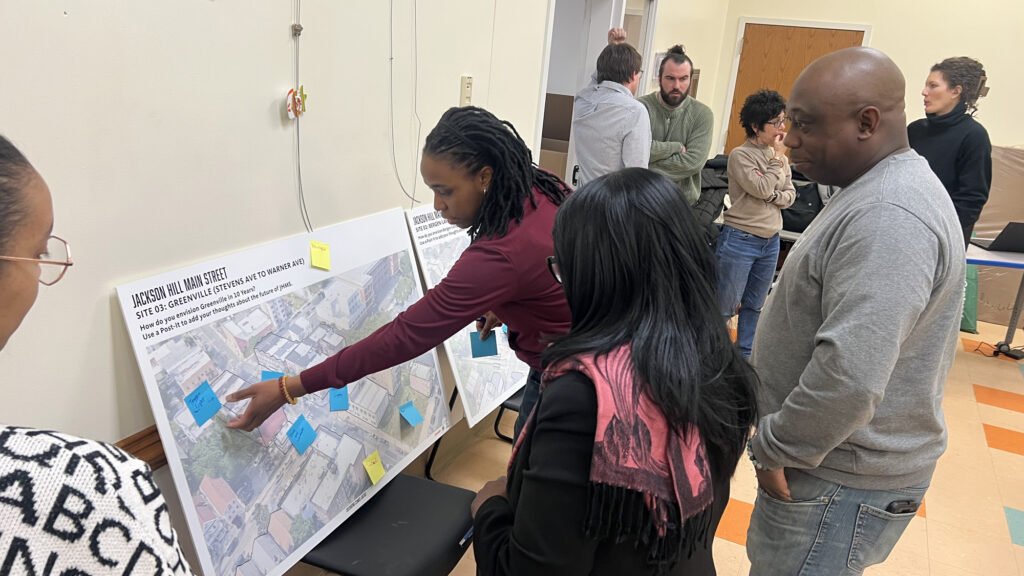

Culture as Economic Anchor — Not Decoration

There is a difference between culture as branding and culture as ownership.

When Black creatives control space — whether through long-term leases, cooperative models, or property ownership — culture becomes an anchor. When they operate only as temporary activations in rapidly appreciating corridors, culture risks becoming a marketing layer for outside capital.

Jersey City’s future economic identity will depend on which model wins more often.

This tension echoes themes we’ve covered in Unlocking the Dream: How the 203k Mortgage is Building Black Wealth in New Jersey and The Hustle and the Heartbeat: Why Black Entrepreneurship in Brooklyn is Their Unbreakable Soul — ownership is slower, harder, and less glamorous than pop-up buzz. But it compounds.

What This Reveals About the Jersey City Creative Economy

The Jersey City Creative Economy is not a single program or district. It’s a negotiation:

- Between grants and rent

- Between visibility and permanence

- Between pilot energy and generational wealth

Black creatives are not waiting for perfect conditions. They are leveraging trust funds, informal networks, cooperative models, and sheer grit to remain visible in neighborhoods they helped define.

The deeper question is whether public investment will evolve from activation funding to structural support — access to capital, favorable leasing pathways, and procurement inclusion.

Because culture without ownership eventually becomes someone else’s asset.

Key Takeaways

- Grants from the Jersey City Arts and Culture Trust Fund provide activation capital but do not replace long-term lease stability.

- Rising regional commercial rents shape pricing pressure even for small creative storefronts.

- “Pilot phase” strategies — short leases, shared studios, hybrid models — are deliberate survival tactics.

- Entrepreneurship remains central to closing structural wealth gaps in New Jersey.

- The long-term health of the Jersey City Creative Economy depends on ownership pathways, not just programming dollars.

HfYC Poll of the Day

Follow us and respond on social media, drop some comments on the article, or write your own perspective!

Do you believe the current Arts and Culture grants in Jersey City do enough to offset rising commercial rent for Black-owned businesses?

- Yes, the funding is sufficient for growth.

- No, we need more direct rent protections or ownership pathways.

- Grants help, but access to capital is still the bigger hurdle.

Poll Question Perspectives

- Are public arts grants a long-term solution for economic equity — or just temporary relief?

- Should Jersey City prioritize commercial rent stabilization for small creative businesses?

- Is ownership — not grants — the real path to protecting Black cultural spaces?

Related HfYC Content

- $600K New Jersey Racial Wealth Gap = Gentrification Today + Homelessness Tomorrow

- Unlocking the Dream: How the 203k Mortgage is Building Black Wealth in New Jersey

- The Hustle and the Heartbeat: Why Black Entrepreneurship in Brooklyn is Their Unbreakable Soul

- What The Real Estate Moguls of NJ/NY Are Doing Right Under Your Nose

Other Related Content

- Jersey City Arts and Culture Trust Fund – Official Program Overview

- New Jersey Institute for Social Justice – Racial Wealth Gap Research

- New Jersey Economic Development Authority – Small Business Services

References

- Jersey City Arts and Culture Trust Fund. (2026). Arts and Culture Trust Fund 2026–2027 Grant Cycle. Retrieved from https://www.jerseycityculture.org/arts-trust-fund

- New Jersey Institute for Social Justice. (2023). The Two New Jerseys: One State of Inequity. Retrieved from https://www.njisj.org/reports/the-two-new-jerseys/

- New Jersey Economic Development Authority. (2026). Small Business Services and Resources. Retrieved from https://www.njeda.com/smallbusinessservices/