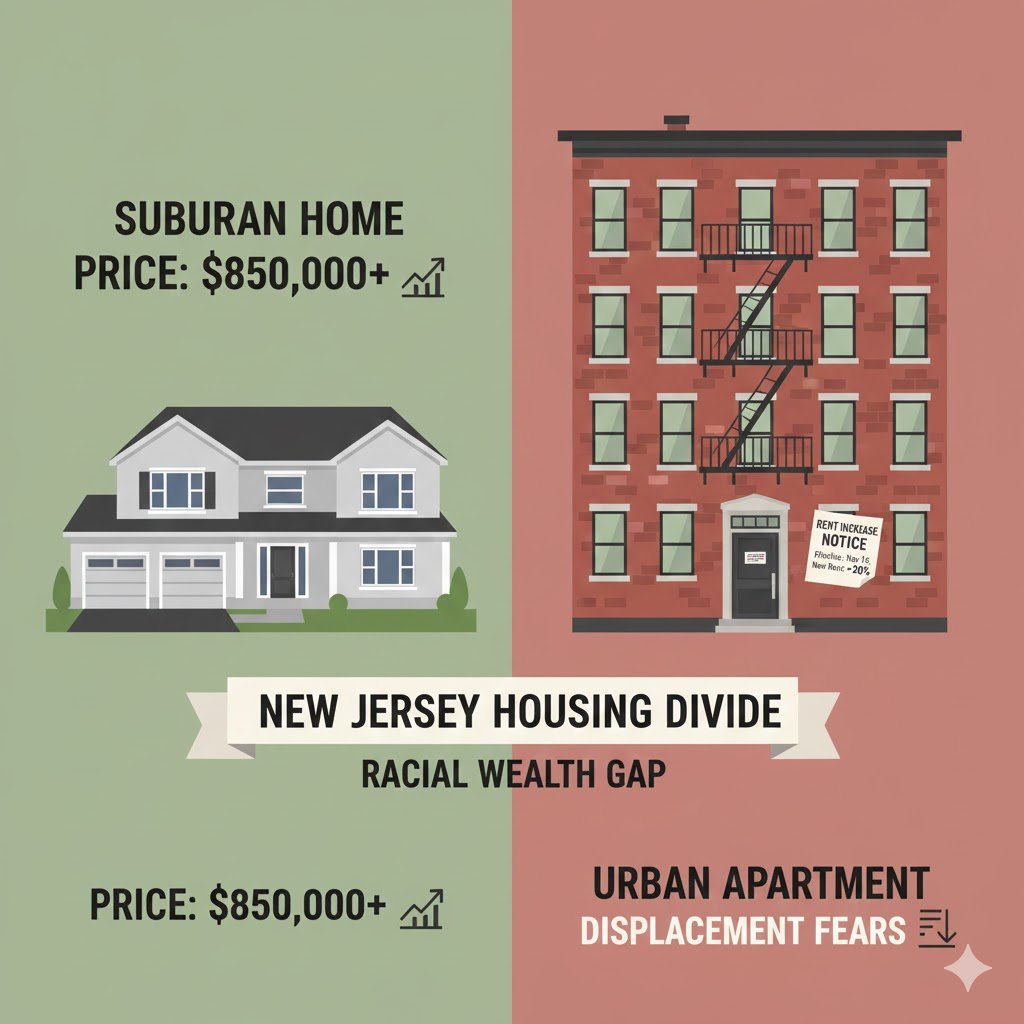

New Jersey’s $600K Racial Wealth Gap — Gentrification Today, Homelessness Tomorrow

New Jersey loves to market itself as a state of opportunity — high incomes, strong schools, “great place to raise a family.” But if you’re looking at it through a Black lens, a different reality shows up in the data: a New Jersey racial wealth gap that has exploded to more than $600,000 between white and Black residents, paired with gentrification and displacement in cities like Newark, Jersey City, and Paterson. YouTube

That number isn’t a typo. New research from the New Jersey Institute for Social Justice, covered by NJ Spotlight News, found that the racial wealth gap in the state has doubled since before the pandemic — from roughly $300,000 to over $600,000. At the same time, Rutgers CLiME and other researchers are ringing alarms about what they call “jobless gentrification” and the quiet displacement of Black residents from long-standing communities. Rutgers Law Centre on Equity

For Black youth and families in New Jersey, this isn’t just an economics story. It’s about losing grandma’s block, your church, the neighborhood barbershop, the corner store that used to let you run a tab — and being told it’s all just “development.”

The $600K Question — How the New Jersey Racial Wealth Gap Got This Wide

When we talk about the New Jersey racial wealth gap, we’re not just talking about income. We’re talking about net worth — everything a household owns (home equity, savings, retirement, business assets) minus what it owes (debt, loans, credit cards).

According to a recent report highlighted by NJ Spotlight News, the gap between the median net worth of white families and Black and Latino families in New Jersey has more than doubled since before COVID — from around $300,000 to over $600,000.

In a state where many white families already had a head start through:

- Earlier access to homeownership

- Intergenerational transfers (inheritance, help with down payments)

- Better access to credit and lower interest rates

the pandemic and subsequent housing boom supercharged existing inequality. Housing values shot up. Families who already owned property watched their wealth climb. Families shut out of ownership — disproportionately Black and Latino — watched from the sidelines while rents and home prices rose around them.

For Black residents, especially in North Jersey, this means:

- Renting in neighborhoods where investor-landlords can flip or sell at any time

- Getting hit with credit requirements that quietly screen out folks with debt or past evictions

- Watching tax breaks go to luxury developments they could never afford to live in

The $600K wealth gap isn’t just a statistic — it’s the distance between staying rooted and being priced out.

“The Other Cities” — How Newark, Jersey City, and Paterson Became Ground Zero

Rutgers CLiME’s report “The Other Cities: Migration and Gentrification in Jersey City, Newark and Paterson”argues that these three cities don’t fit the usual “rich white newcomers take over the city” script — but Black residents are still being pushed out.

The researchers describe them this way:

- Jersey City — “Bedroom City”

Growth tied to proximity to New York City. People sleep in Jersey City and earn their money across the river. Housing prices have soared, and the Black population has dropped by nearly 3,000 residents since 2013. - Newark — “Jobless Gentrification”

New high-end housing and investor-led renovations are raising prices without the local job growth usually associated with gentrification. Longtime residents see higher costs, not higher wages. - Paterson — “Migrant Metro”

A dense, working-class city with major Caribbean, Latino, Arab, and South Asian communities. Even without a big wave of luxury development, home values have nearly tripled in less than a decade, while Black residents are leaving.

Across all three cities, the pattern is the same:

- Rising home values

- Intensifying rent burdens

- Declining Black resident populations or displacement within the metro area

- Rising homelessness counts, including in 2024–2025 point-in-time counts

In other words, the New Jersey racial wealth gap is not abstract. You can map it onto blocks in the South Ward, Greenville, or Northside Paterson and see exactly who’s leaving and who’s arriving.

Newark and “Jobless Gentrification” — When the Rent Goes Up but the Paychecks Don’t

Newark is a case study in how gentrification can be brutal without the glossy downtown tech jobs people associate with places like Brooklyn or San Francisco.

Rutgers CLiME’s work and local reporting show that:

- More than half of Newark residents are “housing cost–burdened,” spending over 30% of their income on rent.

- Homelessness in Newark jumped more than 900 people in a single year, reaching 2,451 in a January 2025 count.

- Investor buying of 1–4 unit homes in predominantly Black neighborhoods has been intense — at one point, almost half of all such home sales in Newark were to institutional buyers and LLCs.

- These investors then set rents and sales prices in ways that benefit distant shareholders, not local families.

Rutgers’ Displacement Risk Indicators Matrix (DRIM) and the report “Who Owns Newark?” make it plain: the foreclosure crisis hollowed out Black middle-class wealth, and corporate buyers moved in to scoop up discounted homes.

So you get:

- Rising rents in West and South Ward neighborhoods

- Longtime Black homeowners squeezed by rising taxes and investor pressure

- Renters pushed into smaller, more crowded units or out of the city altogether

That’s “jobless gentrification” in real time — the landscape looks “revitalized” on a brochure, but the people who held it down for generations are being priced out.

Youth Perspective — When Home Stops Feeling Secure

For Black youth in Newark, Jersey City, and Paterson, gentrification doesn’t show up as a policy term — it shows up as:

- Your favorite corner store becoming a coffee shop with prices in all decimals

- New neighbors who call the cops on the same block parties your family has had for 20 years

- Being told your family “should just move” when the landlord raises the rent by hundreds of dollars

Students notice when classmates disappear because their families had to relocate to East Orange, Irvington, South Jersey, the Poconos, or down South where rent is cheaper. They see aunties moving further out and spending two extra hours commuting.

This instability hits young people in concrete ways:

- Mental health: Anxiety about housing, fear of eviction, and the sense that nothing is permanent.

- Education: Multiple school switches in a few years because each move requires a new district.

- Community identity: Watching Black cultural anchors — hair salons, churches, community centers — either get pushed out or surrounded by developments they can’t afford to participate in.

When you combine the New Jersey racial wealth gap with jobless gentrification, young people are being socialized into a lesson: “You can live here, but you can’t own here.” That message is dangerous.

Housing Policies, Credit Checks, and the Quiet Ways Black Families Get Screened Out

On paper, housing policies often look “neutral”:

- Income minimums three times the rent

- Credit score thresholds

- Background and eviction checks

- “No voucher” or “no subsidy” rules (even where technically illegal)

In practice, they lock out Black families who have:

- Student loan debt

- Medical debt

- Old evictions from the COVID era or earlier

- Limited access to family wealth for security deposits and first/last month rent

Layer that on top of the $600K racial wealth gap and you get a system where new, wealthier residents slide easily into renovated apartments, while Black residents with deeper roots in the neighborhood are told there’s “nothing available” or offered only unsafe, poorly maintained, overpriced units.

Affordable housing lotteries often become a political bragging point more than a lived solution — thousands apply for a handful of units. Meanwhile, landlords can legally (or in the gray zone) select “safer” tenants whose finances already benefited from the state’s unequal wealth landscape.

Short-Term and Long-Term Consequences for Black New Jersey

Short-Term Impacts:

- Forced migration: Black residents moving from North Jersey cities to cheaper suburbs, South Jersey, Pennsylvania, or the South.

- Overcrowded housing: Families doubling up to survive higher rents.

- Increased homelessness: Rising unsheltered counts in Newark, Jersey City, and Paterson.

Long-Term Impacts:

- Lost home equity: When Black families can’t buy or are forced to sell low, they miss out on the primary wealth-building vehicle available to middle-class Americans.

- Political displacement: When Black voters are pushed out of urban cores, their collective political power shifts — potentially diluting representation in local and state government.

- Cultural erasure: As new residents move in without ties to local Black history, institutions that carried that history (Black churches, legacy businesses, civic organizations) struggle to survive.

- Intergenerational wealth freeze: Young people inherit a reality where owning in the communities they grew up in feels impossible, further entrenching the New Jersey racial wealth gap.

What Can Black Communities Do Now? Organizing, Ownership, and Policy Pressure

No single community can close a $600K wealth gap on its own — but communities absolutely can fight to change the conditions that widen it. Some key strategies already in motion across New Jersey and around the country include:

Fight Displacement Through Policy and Organizing

- Tenant unions and associations that can collectively negotiate with landlords and push back on unfair rent hikes and neglect.

- “Good cause” eviction laws that limit when and how landlords can force tenants out.

- Local zoning fights to ensure new development includes truly affordable units, not just “luxury-lite” housing.

Groups like Rutgers CLiME and housing justice organizations in Newark and Jersey City are already producing data and legal frameworks to support these fights.

Build Black-Led Ownership and Community Control

- Community land trusts (CLTs) that take land off the speculative market and hold it in trust for long-term, community-controlled affordability.

- Housing co-ops where residents share ownership and decision-making power.

- Support for Black realtors, Black-owned construction firms, and local developers committed to community-first practices.

These tools don’t magically fix centuries of extraction, but they create pockets of stability in an unstable market — especially when paired with financial education and legal support.

Invest in Financial Literacy and Collective Wealth-Building

- Neighborhood-based workshops on credit repair, homebuying, estate planning, and small business finance.

- Encouraging families to document and protect land/home ownership through proper wills and trusts.

- Cooperative investment clubs that help residents pool money to buy property or support Black-led businesses.

The message to young people needs to be clear:

Your worth is not defined by your zip code, but your future is absolutely shaped by who owns the land beneath your feet.

Key Takeaways — Reading Between the Lines of “Revitalization”

A few core truths to carry forward:

- “Revitalization” without protection is just displacement with better PR.

- The New Jersey racial wealth gap is not just about money — it’s about control over space, time, and opportunity.

- Jobless gentrification proves that shiny buildings don’t equal shared prosperity.

- Black communities need data, organizing, ownership, and storytelling — all working together — to resist erasure.

- Youth deserve to see a future where staying, owning, and thriving in New Jersey is possible, not a fantasy.

Call to Action — From “Surviving” to Setting the Terms

If you’re reading this from Newark, Jersey City, Paterson, or any other New Jersey community under pressure, here are tangible next steps:

- Get informed: Follow organizations like the New Jersey Institute for Social Justice and Rutgers CLiME that track the New Jersey racial wealth gap and displacement trends.

- Get organized: Join or help start tenant groups, neighborhood associations, and mutual aid networks that can negotiate and advocate together.

- Get intentional about wealth: Even small steps — paying down high-interest debt, learning about homeownership options, or supporting Black-owned financial institutions — matter in the long game.

- Protect legacy: Talk with elders about titles, wills, and estate planning so property doesn’t quietly vanish due to paperwork, taxes, or predation.

We may not have written the rules of this game, but we can absolutely refuse to play it on “auto-pilot.”

HfYC Poll of the Day

If the New Jersey racial wealth gap is now over $600K, is gentrification in cities like Newark and Jersey City “revitalization” — or just a slow eviction notice for Black communities?

Alternative Perspectives:

- When you see Black families pushed out while investors flip whole blocks, do you blame “the market,” policy choices, or us not owning enough of our own neighborhoods?

- Do you think New Jersey’s racial wealth gap is driven more by housing policies and credit systems, or by job and income differences?

- If your block suddenly got a yoga studio, a wine bar, and your rent went up $500, what’s your next move — organize, relocate, or run for council?

Related HfYC Content

- First-Time Black Homebuyer’s Guide to NJ & NY | Assistance & Grants

- A Playbook for Buying a House and Building a Fairer Future

- Unlocking the Dream: How the 203k Mortgage is Building Black Wealth in New Jersey

- Is the U.S. Housing Crisis a Bubble About to Burst—or a Slow Reset?

- What The Real Estate Moguls of NJ/NY Are Doing Right Under Your Nose

Other Related Content

- The ‘Other’ Cities: Migration and Gentrification in Jersey City, Newark and Paterson, New Jersey – Rutgers CLiME

- Racial Wealth Gap Widening in New Jersey – NJ Spotlight News (NJ PBS)

- Who Owns Newark? Transferring Wealth from Newark Homeowners to Corporate Buyers – Rutgers CLiME

- Black Residents Are Leaving These Three NJ Cities. What Else to Know From This New Report – Bergen Record / The Wire 98.5

References (APA Style)

- Center on Law, Inequality and Metropolitan Equity. (2025, April 1). The “Other” Cities: Migration and gentrification in Jersey City, Newark and Paterson, New Jersey. Rutgers Law School.

- Center on Law, Inequality and Metropolitan Equity. (2017–2025). Who owns Newark? Transferring wealth from Newark homeowners to corporate buyers. Rutgers Law School. Rutgers Law Centre on Equity

- NJ Spotlight News. (2025, April 8). Racial wealth gap widening in New Jersey [Video]. NJ PBS. https://www.youtube.com/watch?v=WWqx9mVuQQA YouTube

- Bergen Record. (2025). Black residents are leaving these three NJ cities. What else to know from this new report.Reprinted by The Wire 98.5. thewire985.com+1

- The Jersey Vindicator. (2025, April 28). The shady side of Newark’s urban renewal. The Jersey Vindicator

- CREA United. (2025). Migration and gentrification in New Jersey in 2025. CREA United

2 Comments